costa rica income taxes

The first step towards understanding the Costa Rica tax code is knowing the basics. It assumes that in all cases expenses total 15 of rental income so it imposes taxes only on the remaining 85.

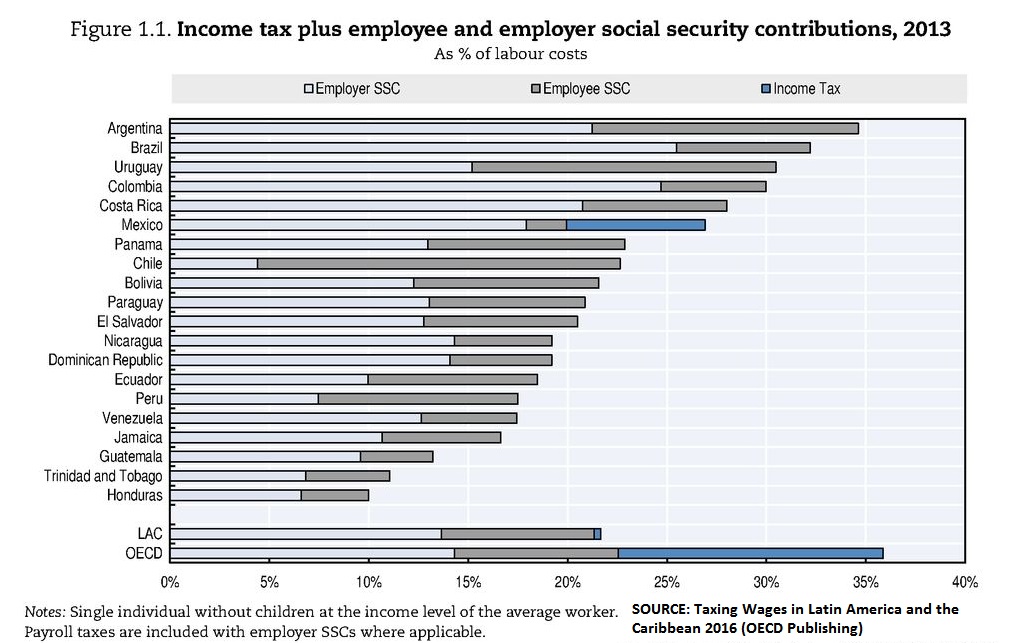

Income Tax Policies Hindering Quality Job Creation Nearshore Americas

In Costa Rica income tax rates are progressive.

. The Personal Income Tax Rate in Costa Rica stands at 25 percent. However if youre a non-tax resident your income tax rate. Once registered then you have the obligation to file your income tax return and pay any income tax that is due.

It allows you to exclude. And it imposes a flat rate of 15 on that 85 eliminating the. 5 on the first CRC 5286000 of.

The tax increases slightly each year and is due. For self-employed rates range from 10 to 25. Paulina Ramírez legislator for the Partido Liberacion Nacional PLN explained that the bill had many technical and legal weaknesses that made it politically unfeasible.

Single Labor Income Tax According to Article 32 of the Income Tax Law individuals domiciled in Costa Rica who receive income from dependent personal work. The tax rate is progressive and there are different tax. Employment income on a monthly basis of individuals is subject to a tax of up.

The Costa Rican government not only taxes active corporations those that actively do business but also inactive ones. Income from employment monthly of individuals is taxed up to 15. Personal Income Tax Rate in Costa Rica averaged 1658 percent from 2004 until 2022 reaching an all time high of 25.

With the new law capital gains are subject to a 15 tax which will be paid either through withholding at source or when the tax cannot be withheld declaration by the taxpayer. Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher salary. 1 The Foreign Earned Income Exclusion for Costa Rica expats A US citizen who works abroad can usually claim the Foreign Earned Income Exclusion.

Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation. The determines a tariff scale for legal persons whose gross income does not exceed the sum of CRC 112170000 during the fiscal period. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income.

How does the Costa Rica tax code rank. Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. Any income you make within the country either through employment a business or a vacation rental is subject to Costa Rican tax.

Costa Rica taxes your income according to the follow sliding. The Costa Rican income tax rate varies based on what type of income you receive. Below we have highlighted a number of tax.

Costa Ricas income tax system is based on the.

Read This Legal Breakdown Of Costa Rica S Global Income Tax Project

Costa Rica Rental Income Taxes Special Places Of Costa Rica

Are You Paying Too Much In Taxes Q Costa Rica

New Taxes And Obligations In Costa Rica Know Before You Invest

Let S Talk About Latin America Htj Tax

How Much Is The Costa Rica Company Tax For 2021 Costaricalaw Com

Costa Rica Expat Taxes Ultimate Tips You Need To Know

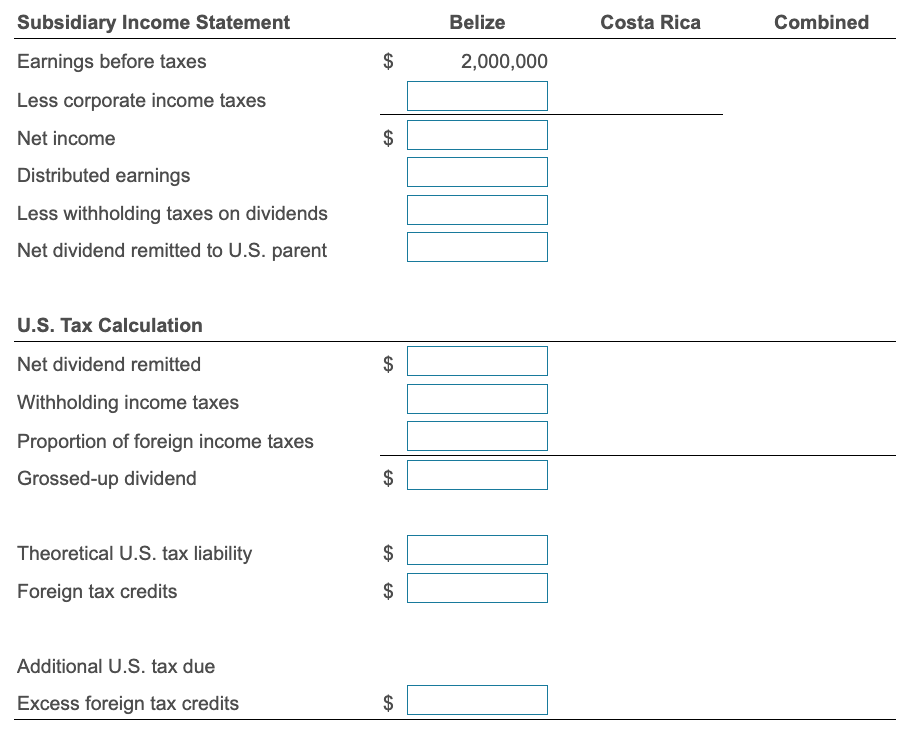

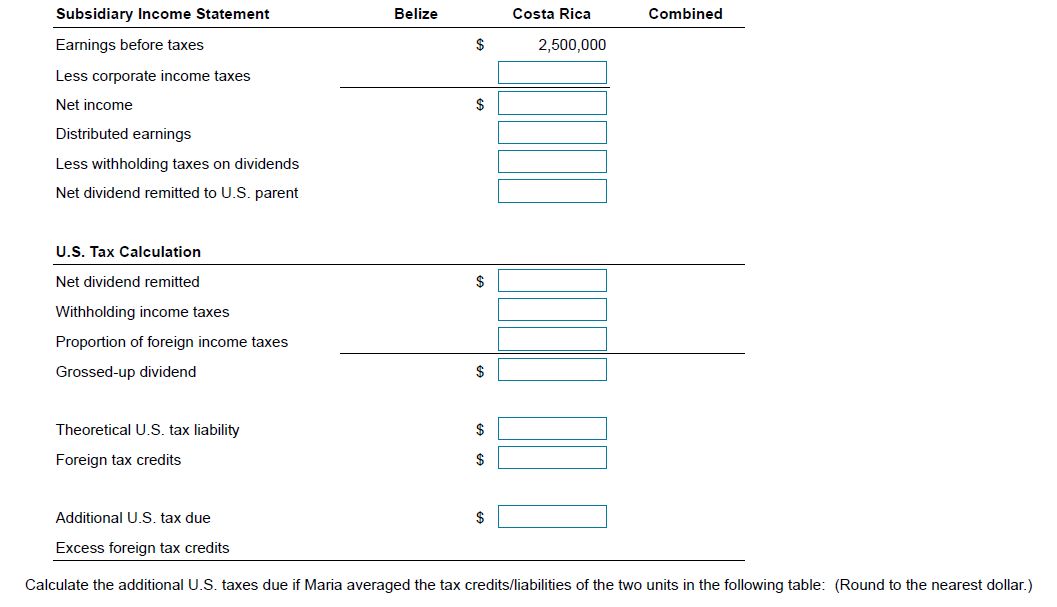

Solved Gamboa S Tax Averaging Gamboa Incorporated Is A Chegg Com

Complete Guide To Hiring In Costa Rica Global Expansion

Simple Tax Guide For Americans In Costa Rica

Dentons Global Tax Guide To Doing Business In Costa Rica

National Income Per Capita Costa Rica 2021 Statista

Expats In Costa Rica Law To Attract Investors And Retirees 2022 Update

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

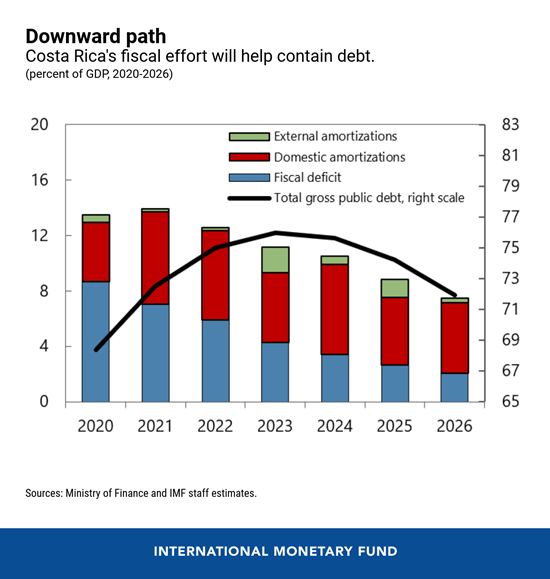

Costa Rica S President No Growth And Poverty Reduction Without Economic Stability

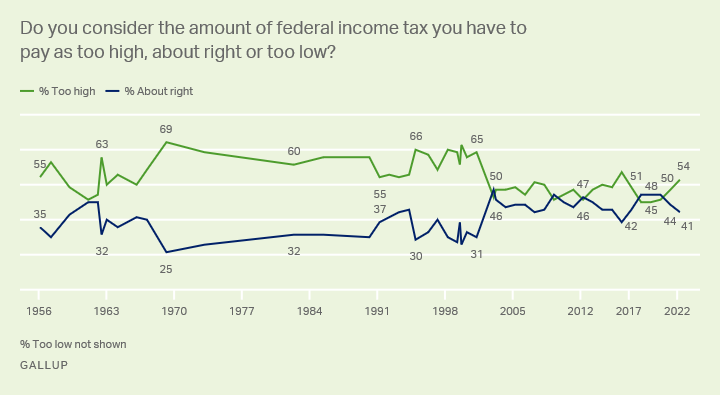

Taxes Gallup Historical Trends

Costa Rica Updated Income Tax Brackets Kpmg United States

Solved 2 Gamboa S Tax Averaging Gamboa Incorporated Is A Chegg Com

How To File Us Income Taxes When Living In Costa Rica Online Taxman